Cryptocurrency best practices

“Be your own bank”

…is the inofficial motto of the cryptocurrency community. But as Spiderman’s uncle Ben so perfectly put:

“With great power comes great responsibility”

The money in the “Swiss bank account in your pocket” can only be as safe as the with real banks if you consider a couple of things concerning cryptocurrencies.. The following (incomplete) list gives you best practices in dealing with cryptocurrencies.

Research

- Be open for new things. Nearly everyone who heard about Bitcoin for the first time was skeptical.

- Be curious about this technology and inform yourself extensively about Bitcoin and cryptocurrencies.

- Do not accept single sources as facts (this includes the source you’re reading).

- Especially information coming from mass media was badly researched in the past.

- Get to know how value is generated (scarcity and usability). Why is gold considered valuable?

- Understand the motivation behind the creation of Bitcoin and why it was a direct response to the financial world and monetary policies of the central banks.

- Understand the fundamental differences between the various kinds of cryptocurrencies (not translated yet).

Buying your first cryptocurrencies

- Don’t invest more than you can afford to lose.

- NOBODY is able to tell you whether now is a good time to buy or not.

- Regularly invest smaller amounts in case you fear having a bad timing. The keyword here is “Dollar Cost Averaging“.

- Cryptocurrencies are a “high risk, high reward” situation. You can lose everything or gain a lot.

- Buy one of the “big” cryptocurrencies first, Bitcoin (BTC) or Ethereum (ETH). They have most likely proven to be safe. On top, you can buy all other cryptocurrencies with BTC or ETH.

- If your purchase is supposed to be as uncomplicated as possible use Coinbase. You (and us, too) will get 10 $ welcome bonus with this link.

- Establish 2-factor-authentication (2FA) for every account in which you store cryptocurrencies.

- Keep the 2FA backup code which is shown in the process safe (offline). This helps to ensure your access even when you lose your cell phone.

- Verify your account, at least with those providers where you exchange Euros for cryptocurrencies.

Buying and trading other coins

- No one can tell you which coin will be “the next big thing”.

- Do your own research! On the internet everyone tries to hype the coins in their own possession. Sometime not even with a bad intent.

- Negative statements about coins should be treated skeptically. Spreading “FUD” (fear, uncertainty and doubt) seems to be part of the game.

- You can only form an opinion when you understand the project behind the coin.

- Invest only if you understand why a coin should have value.

- Never put all your money in a coin that does not yet have a long history.

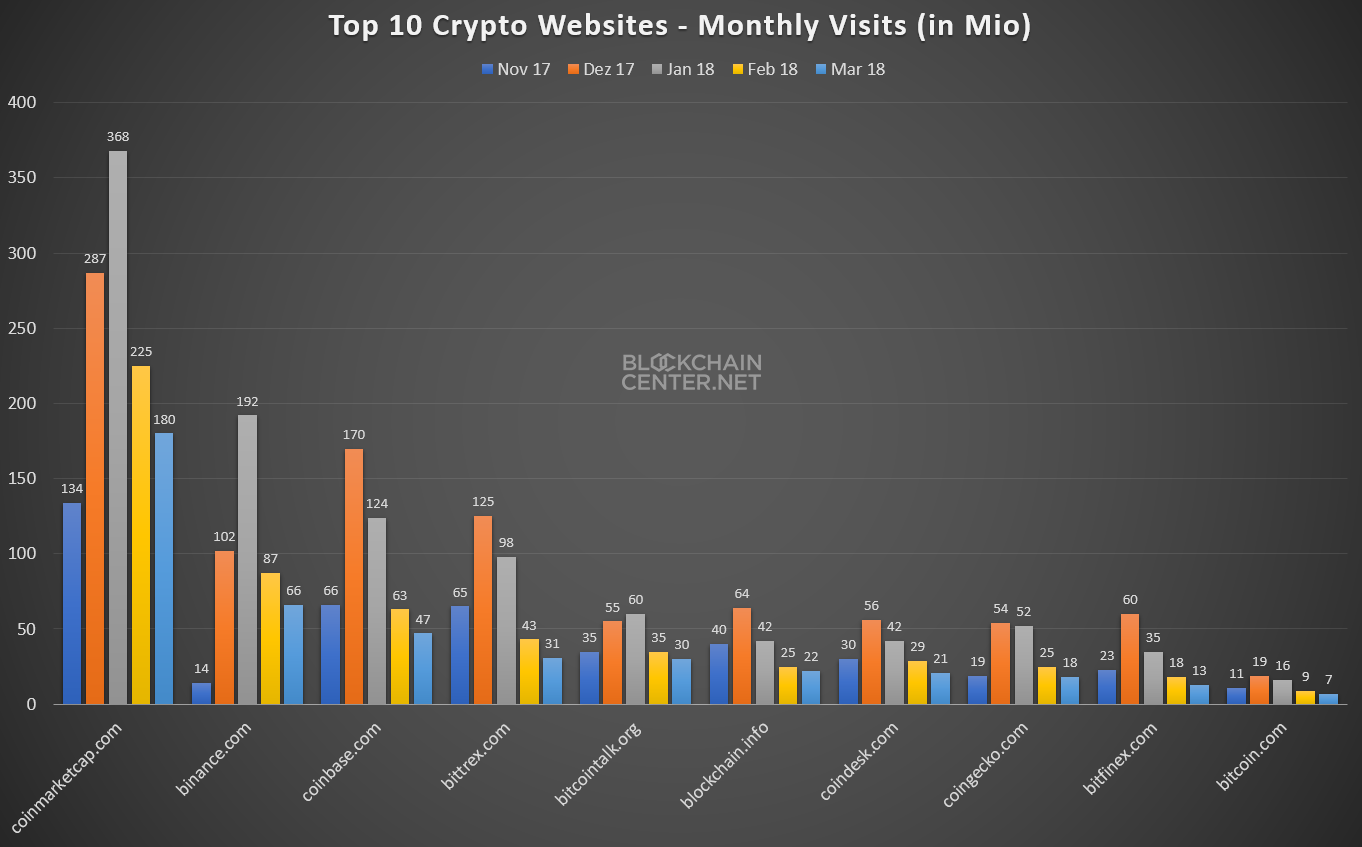

- Use one of the big crypto exchanges which offer many coins and have low trading fees for your purchase, e. g. Binance or Bittrex.

- Use an exchange (like Binance), and not a broker (like Coinbase) when you buy and sell often to save on fees.

- Use ETH, wherever possible, to buy other coins. This means lower transaction costs for you and it is quicker than with BTC.

- Remember purchase and transfer fees of cryptocurrencies. It’s easy to dismiss them when you look at the price volatility.

- Make sure to pay attention to the instructions when you send cryptos to exchanges. Occasionally, information other than the payment address is needed

- Pick a long-term investment strategy and stick to it.

- Be aware of the diverse cognitive biases of investors. You will find an example here.

- Be patient! Do not let yourself be influenced by information which impacts on a short term, but does not change the long-term strategy.

- If you check the price or state of your portfolio every 30 minutes (“blockfoliotitis”) you are probably too heavily invested.

- Sell a portion if thats the case.

- Overmonitoring (a too frequent checking of your portfolio) leads to overadjusting of your positions and regret.

- Follow the technical and infrastructural developments of the cryptocurrencies in your long-term portfolio. Good sources of information are the respective subreddits or Telegram/Discord/Slack channels.

- Try to keep emotion out of the game.

- Avoid the FOMO syndrome!

- When in doubt, zoom out: Short-term corrections are nothing out of the ordinary. It helps to look a a longer time range.

- Buy low, sell high. (Uhhmm…OK, if it was that easy, I know).

- Nothing gains forever. The next bubble is sure to be on its way, just like the next price correction.

- Realise profits. This lets you sleep better and it reduces your cost base.

- Don’t try to hit the peak of a bubble when you sell, but be satisfied with moderate gains.

- Understand that sometimes, you need to realize losses, and don’t fall victim to the “sunk cost fallacy“.

- Look at the price of a coin in Bitcoin, not in euro, to gauge the performance. (When HYPECOIN gains 10 % in comparison to the Euro, but BTC 15 %, it is actually a loss). Use our tool to compare the performance of two coins.

- Every type of chart analysis (technical analysis) is bullshit, especially when it comes to cryptocurrencies (this is our own opionion).

- You can’t draw conclusions about the future from past price data.

- Help others to understand cryptocurrencies, but never persuade them to invest.

Using and securing cryptocurrencies

- Consider which share of your coins you want to store on exchanges and do it consciously. Exchanges have often been hacked, however, they have progressively become more secure.

- Test different wallets of different cryptocurrencies to get a feeling for the functioning, strengths and weaknesses.

- Use, wherever possible, a hardware wallet for larger sums.

- Double check the target address if you send cryptocurrencies.

- Check the transaction fee when sending money from wallet or hardware wallet.

- Always do the suggested wallet backups.

- Use a password manager like KeePass to save seeds and passwords.

- Pay attention to what you download (e. g. wallet software), which links you click on and which websites you visit.

- Avoid wallets where you create the seed or keys online (there are legitimate ones, though). If you do that, then only in offline mode and only when your computer is “safe”.

- Only use apps from the official app stores and do not ‘root‘ your smartphone.

- In case of doubt your smartphone (with PIN/pattern/finger print lock) is safer than your desktop computer.

- Store physical seeds (e. g. by Trezor or Ledger) or paper wallets fire- and water-proof.

- Don’t put unencrypted wallets or backup files on Google Drive, Dropbox or similar.

- USB sticks or SSD cards can break and are not an appropriate backup solution.

- Protocol your purchases and sales for tax reporting purposes. The tax authorities will come knocking sooner or later (but rather later).

- Germany:Keep your coins for longer than a year so that you do not have to pay taxes. For more info, see our guide on taxation of cryptocurrencies.

- Even though there are enough ways to avoid dealings with the tax authorities, don’t be tempted.

- Don’t invest in initial coin offerings (ICOs), unless you know exactly what you’re doing.

Further Best Practices

- Don’t let others manage your coins.

- Don’t share your private key or seed with anyone.

- Don’t fall for online scams.

- If it sounds to good to be true it probably is.

- Don’t tell anyone how many BTC and other coins you have.

- Don’t ask anyone how many BTC and other coins they have.

- Take measures so that your relatives will have access to your cryptocurrencies in the worst case.

And the most important tip of all:

- HODL! It’s not just a meme, but a life philosophy!

Pretty sure this list is no were near complete. If there are aspects missing we would love to get your comment!