When Mainstream? A sobering look at Bitcoin & Crypto

What actual benefit do Bitcoin & Co provide for the average consumer?

The comparison of the development of cryptocurrencies and blockchain applications to the early days of the internet is as old as Bitcoin itself. Critics of crypto are often reminded that the internet, with Google, eBay, and Co., only hit the mainstream 10+ years after the development of the World Wide Web and 30 years after the invention of ARPANET (the precursor to the internet). Netflix, YouTube, & TikTok even took 20 years and longer, requiring significant technological advancements (bandwidth, mobile devices) to enable these use cases at all.

But is this analogy still valid? How long can we continue to refer to it? Where are we currently? When will the breakthrough come for cryptocurrencies? When for Bitcoin? And how?

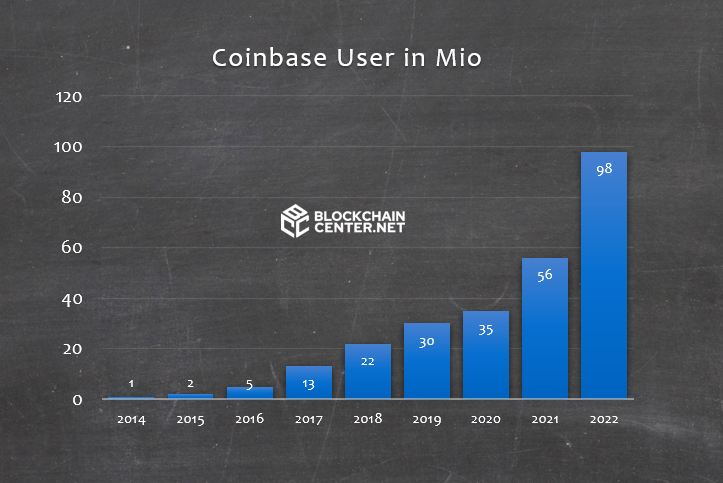

Hundreds of Millions of Users Speculate

According to company data, over 100 million speculative crypto investors have an account with Coinbase. Binance even reports 140 million users. Many of these likely joined during the peak times of the last two hype cycles in 2017 and 2021. Even if probably only a portion of these users actually bought cryptocurrencies for a significant amount, it is clear that Bitcoin & Co. have at least reached the mainstream in terms of investment or speculation.

However, speculating on meme tokens and pyramid schemes is certainly not what Satoshi had in mind when he invented a trust layer for the internet, a way to establish trust between two parties without an intermediary.

So what is the real benefit?

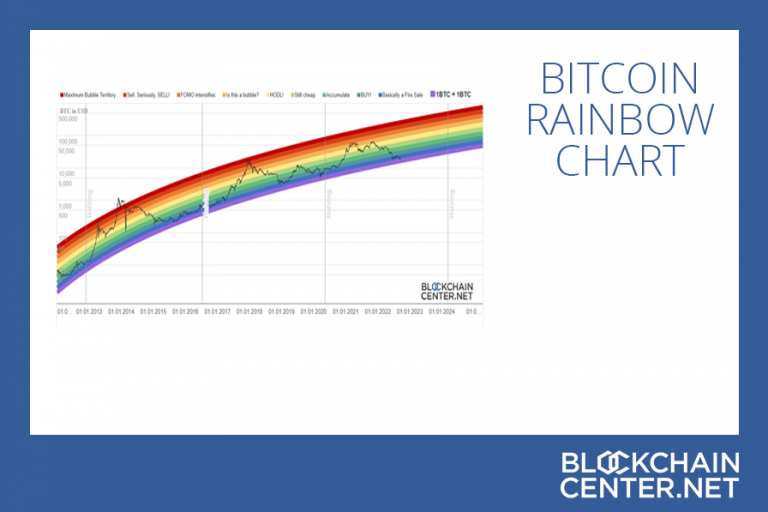

Bitcoin

Almost everyone feels it: something is going wrong with our current financial system. The rich are getting richer, the poor are getting poorer. Constant inflation is eating up savings and leading to excessive consumption of products, whose quality seems to be steadily decreasing. Both parents have to work to make ends meet, and real estate in urban areas is usually only affordable for those who have inherited or come into money in some other way.

For us Bitcoiners, it’s clear: the cause of this is the unsound money, the amount of which is determined by central planning. Fiat currencies like the euro or the dollar are the root of all evil.

If only everyone would understand this, the theory goes, Bitcoin would have an easy time because of its superior characteristics as sound money: people would no longer give up their work and life time for money that others can simply print out of nowhere, they would only offer goods and services for Bitcoin. A Bitcoin standard would be the result.

Unfortunately, recent years have shown that these conclusions are not immediately clear to everyone and many are not interested in “orangepilling” or “Bitcoin rabbit holes.”

Bitcoin is not easy to understand, and the media does not exactly help to question the status quo. They prefer to focus on supposed scandal topics such as energy consumption or the use in the dark web.

Of course there are indeed critics of a Bitcoin standard. Nevertheless, almost everyone who seriously learns about our monetary system must at least acknowledge that Bitcoin could be a potential solution. Therefore, it can be assumed that the number of Bitcoin supporters will continue to increase over time. Even presidents of sovereign states, such as in El Salvador, have already been “orange pilled,” and the introduction of Bitcoin as legal tender in the country was definitely a milestone in the adoption of Bitcoin.

However, the lack of enthusiasm among the citizens of El Salvador shows that we are still far from reaching the mainstream.

Cryptocurrencies as a Payment System

There was a time (2016-2017) when almost every week a new major company announced that they would accept Bitcoin as a payment method on their platform. Expedia, Dell, Microsoft, Overstock…What once started in the darknet seemed to be spilling over into the real economy. The reasons for these companies were (and still are) convincing: No fees to payment service providers, no payment defaults due to credit card fraud, no chargebacks. Bitcoin is the future!

However, these companies quickly realized that, after the initial marketing effects, hardly anyone paid with Bitcoin. To make matters worse, transactions were no longer nearly free of charge because of the capacity limit (block size) being reached for the first time.

Copies of Bitcoin, which advertised with low transaction costs and high transaction throughput, saw their chance – but Dash, Bitcoin Cash, and all the others had to admit that there is simply no demand for cryptocurrencies as a payment system! This is still the case today. Almost all companies from back then have discontinued Bitcoin payments.

The reasons are obvious: The average consumer buys Bitcoin & Co. as an investment. They don’t want to spend them. After all, they could be significantly more valuable tomorrow.

Aside from that, every purchase with Bitcoin is a potentially taxable event that needs to be recorded. I don’t even want to start on the technical challenges of the Lightning Network and self-custody.

As a payment system in the real world, Bitcoin and therefore also Lightning, remain a tool for idealists.

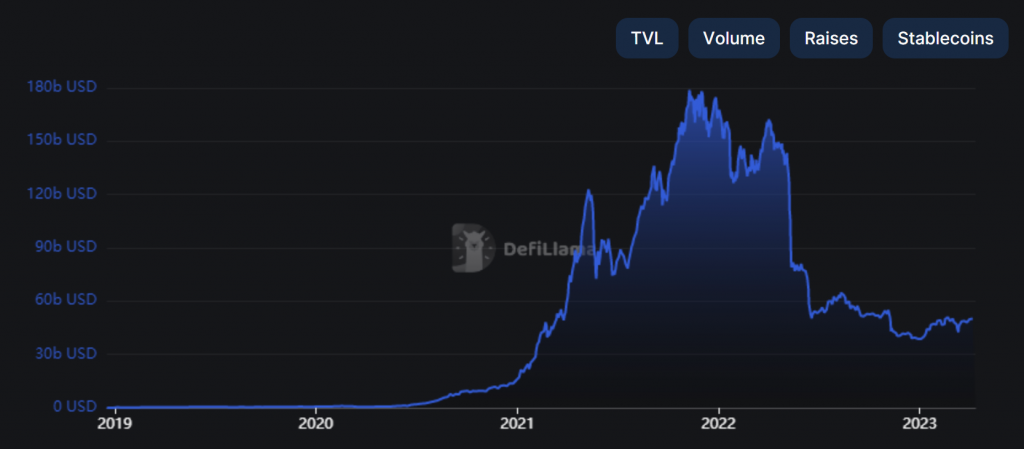

Ethereum, Smart Contracts and decentralized Finance

Nothing less than a completely new financial system, with programmable transactions (Smart Contracts) instead of greedy financial service providers, open to everyone instead of KYC/AML restrictions is one of Ethereum’s visions. And indeed: during the “DeFi Summer” of 2021, decentralized exchanges, lending, and interest products experienced a massive influx. However, not from the average consumer… The transaction costs were too high, the technical hurdles barely surmountable, and the benefits not really self-explanatory.

Today, we can admit: Fortunately! Otherwise, the losses due to bugs and hacks in said Smart Contracts would probably have caused much more damage. Not to mention the various Ponzi schemes disguised as complex financial products.

Today, the “Total Value Locked”, i.e. the sum of values that are tied up in Smart Contracts, is a fraction of its former value.

Users continue to be primarily early adopters and well-funded “whales”. After the first wave of actual innovations like Uniswap and Aave, new smart contracts coming onto the market are more evolutionary than revolutionary. The umpteenth Uniswap clone is just as unlikely to attract the masses as the latest Ponzi gambling yield farming application.

Despite some growth in the number of transactions and the possibility to scale with Layer 2 solutions like Arbitrum or Optimism, DeFi is currently falling significantly short of expectations in terms of mainstream adoption. What’s missing is another “killer app” like Uniswap, which is in such high demand that users are willing to learn the complicated processes in crypto.

Stablecoins – Tether, USDC & Co.

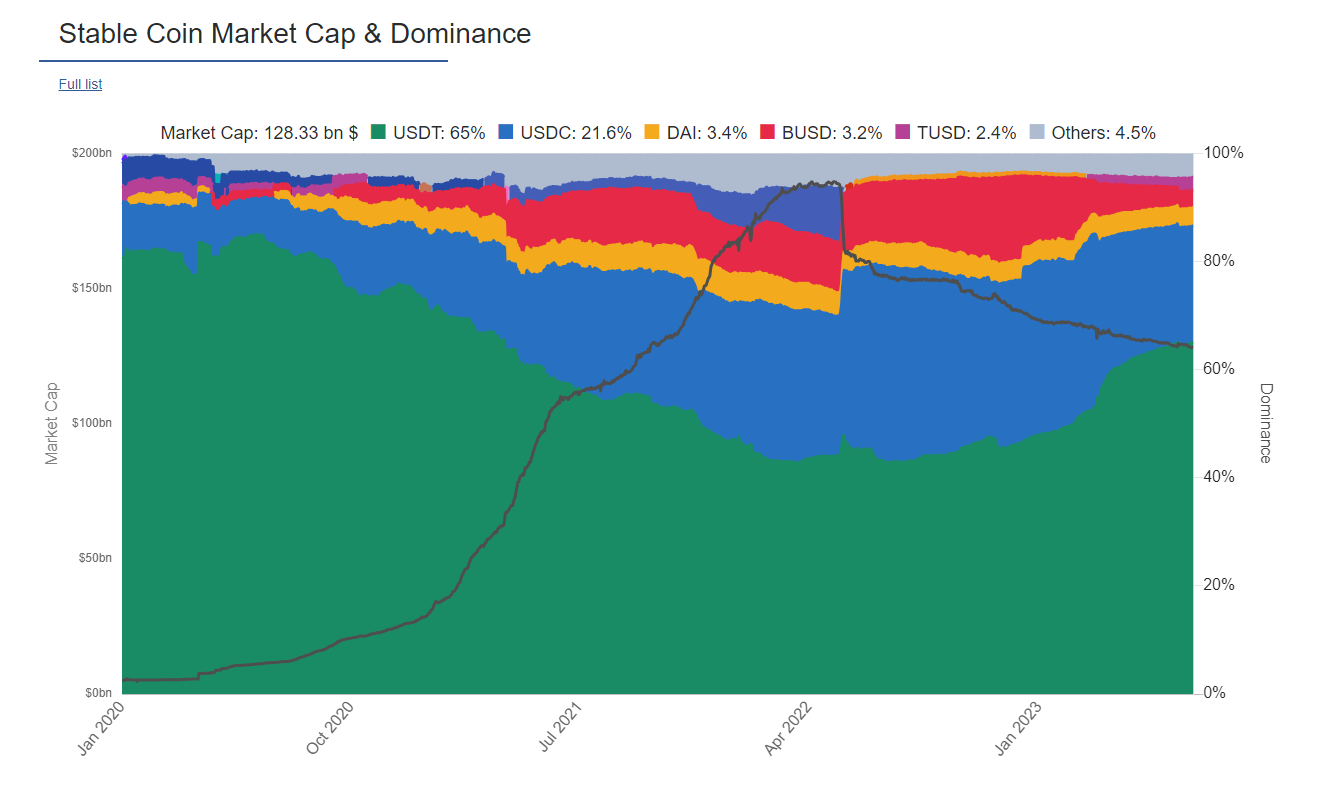

Stablecoins, i.e. dollar-backed tokens that hold their value (at least compared to fiat currencies), are a real success story. They allow speculators to quickly switch from and to volatile cryptocurrencies and give people in countries with weak own currencies access to the world reserve currency.

Tether (USDT), the largest stablecoin, reported a profit of nearly $1.5 billion in Q1 2023. With only a two-digit number of employees, iFinex (the company behind Tether) is probably one of the most successful companies worldwide in terms of employee-to-profit ratio.

A big part of the success of stablecoins is due to their easy handling and integration into crypto exchanges. The transactions take seconds and work 24 hours a day.

Of course, one reason for the meteoric rise of stablecoins is also that capital market controls only partially apply so far. Stablecoin transactions in the millions are the order of the day, and usually, no one asks where the money comes from or where it goes. The exception is known addresses of hackers or other villains according to the OFAC sanctions list.

Unless there are -quite likely- setbacks in adoption from regulators, stablecoins should continue to be a success model in the crypto industry.

NFTs

The history of the crypto industry is marked by “boom and bust” cycles. Whether it’s Bitcoin speculation bubbles, the ICO mania of 2017, DeFi summer, or the NFT hype. Phases full of absurd valuations and gains, followed by sobering reality. While some of the famous “Bored Apes” NFTs still went over the table for millions, nowadays you can get a “digital monkey picture” for under a hundred thousand dollars.

Something was new with NFTs though: For the first time, it seemed as if the aforementioned, usually crypto-foreign, average consumer might be interested.

Sorare brought in sports enthusiast fantasy basketball players, art collectors exhibited NFTs, celebrities bought NFTs, mainstream media reported. For a while, it looked like NFTs could help the crypto industry break through. With the bursting of the bubble and falling prices, however, there is now disillusionment again. Having an NFT as a profile picture on social media accounts is almost embarrassing again…

But NFTs are actually much more than pictures. But even music NFTs, gaming items, authenticity certificates linked to real goods, or Metaverse property are currently far from playing any prominent role in the life of the average citizen.

Other Use-Cases

Who still remembers blockchains in supply chains? Payments in the Internet of Things? Decentralized data storage networks? Tokenization of stocks, buildings, and basically everything? None of these narratives have been successful so far, virtually all “proof-of-concept” projects remained -well- a concept. Many blockchain critics (including from the Bitcoin corner) have long suspected that “blockchain technology” is a solution looking for a problem. The current state, at least outside of the financial sector, proves them right.

“And then there are DAOs (Decentralized Autonomous Organizations). In theory, an exciting concept and in combination with AI with almost creepy potential, but so far it remains just that: potential”

Although many projects, especially in the Ethereum environment, are already led by such interest groups, they are rather semi-decentralized, definitely not autonomous organizations. And of course, no sign of mass adoption.

Conclusion

In my opinion, the comparison with the early days of the internet is not yet overused. 12 years after I chatted for the first time, Amazon was just a slightly improved bookstore, and my order history started even 4 years later.

Many people thought they would never order shoes online because you have to try them on, but generally, it was clear to everyone that the internet would be huge. I don’t really see that with Bitcoin and crypto outside of the community though.

Every new technology that wants to change the world has to convince the general public after the “early adopters”. For that we still need a use case that is so obvious to the average consumer that they go through the hoops of learning crypto processes.

Bitcoin, on the other hand, does not need a “killer app” for success. Like all currencies in the history of mankind, the euro and dollar are also doomed to fail at one point. Whether Bitcoin is then ready to offer people a serious alternative, however, is far from being as predetermined as we would like it to be.