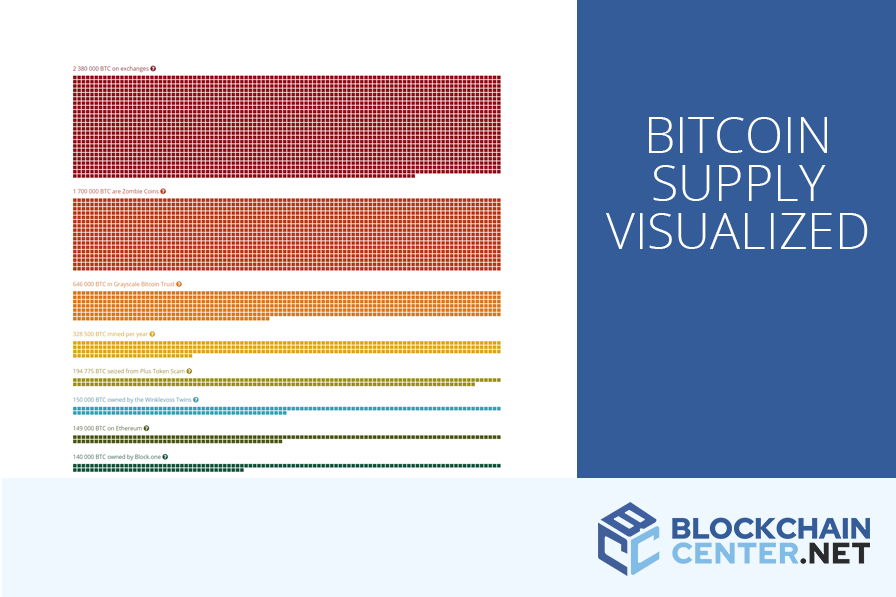

640,250 BTC

Invested: $ 47.822 billion,

currently worth: $ 65.124 billion (36 %)

18,646,216 ETH

currently worth $ 62.184 billion (30 %)

Microstrategy BTC Holdings

And what if Microstrategy had bought ETH instead?

And what if Microstrategy had bought ETH instead?

17.302 billion USD

with BTC

14.362 billion USD

with ETH

What about staking?

1,031,284 ETH

at 4%, currently worth $ 3439.3 million

19,677,500 ETH

currently worth $ 65.623 billion

What if he buys ETH now?

19,527,747 ETH

...if he trades his BTC for ETH now...

3256 million USD

Microstrategy never had this much operating income

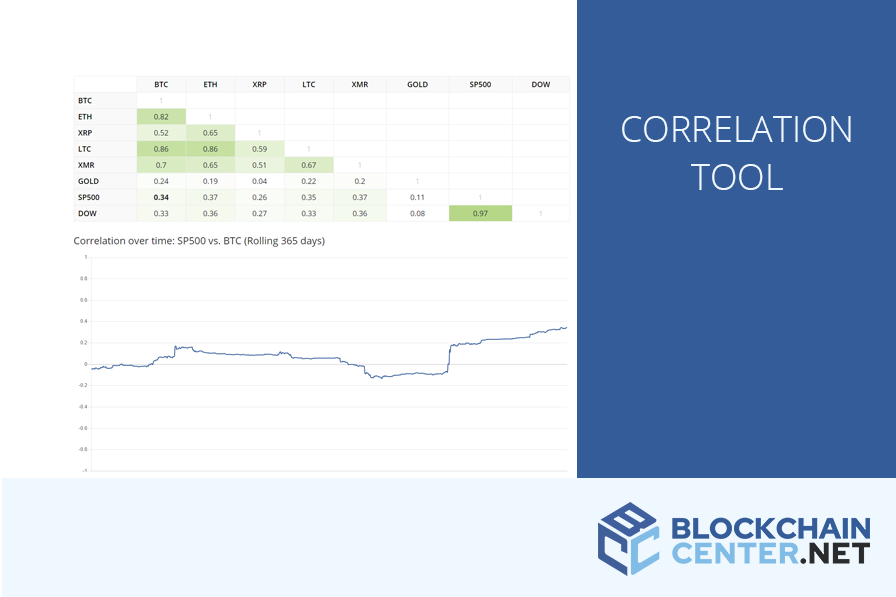

Why this visualization?

Mainly because the data nerd in me was interested in the data. Now you can also use it for your petty Twitter dunks on Michael Saylor. Of course hindsight is 20/20, and his decision to convert his company cash (and more) into Bitcoin could have been (and still can be) the greatest decision ever. But saying “there is no second best crypto asset” is a bit of a stretch if you ask me and the data that is currently available.

Update September 2024: Currently Saylor is up on his investment versus Ethereum so no more dunks. Instead we have to admit that it seems like: THERE IS NO SECOND BEST!!!