Non-fungible Tokens (NFTs)

Key facts about NFTs

- Non-fungible tokens, unlike coins, are unique and cannot be exchanged for other tokens.

- Non-fungible tokens are thus excellent representatives of digital or real assets.

- NFTs already exist in some ecosystems, for example Ethereum.

- They are often intended as collectibles, for example as is the case for the CryptoKitties.

- Non-fungible tokens can be traded on platforms and specialized marketplaces.

What are non-fungible tokens?

A non-fungible token is a cryptographic token that occurs only in one instance. Users cannot exchange it like to like for another token, copy it, destroy it or share it. Thus, it is the counterpart to the utility token, which can be consumed and split.

“Non-fungible” refers to the fact that the token cannot be substituted.

For example, 1 ETH has the same use value as another ETH. An NFT, as it is abbreviated, is not comparable to another NFT at all.

Sometimes known as a Nifty, it is characterized by its own unique features. Due to these characteristics crypto enthusiasts use it as a digital representative of assets. The most famous example is CryptoKitties. They have been highly traded precisely because they are unique.

Users trade non-fungible tokens on both centralized and decentralized platforms. Direct exchange between owners is also possible via their wallets.

Potential

Non-fungible tokens have come into such focus because they have great potential. Their uniqueness means that ownership can be clearly represented and allocated.

For example, they might be linked to tangible assets such as houses, land or jewelry. But completely digital representation is also possible so that new categories of ownership can be introduced – while retaining all the advantages of decentralized systems.

As indivisible, but equally tradable and borrowable units, NFTs provide many options for monetization. Factors such as rarity or scarcity of certain categories of NFTs increase their value. For example, creators can issue “series” of non-fungible tokens.

Bubbles are a potential consequence. How easily can it be ensured that the real asset value is deposited? How safe is the monetary valuation of an NFT? Is the demand really as high as indicated?

Out of all these points, the latter is difficult to define. Stocks, money or gold can be substituted for each other. NFTs, on the other hand, are always individual items.

In addition, they are not easy to program or “produce” in all ecosystems. In some cases, high costs are incurred, and it happens with technology that could already be obsolete in 5-10 years. Here, it is important to ensure compatibility in a consistent manner.

Blockchains with non-fungible tokens

NFTs are currently used to a limited extent. This is also owing to the fact that many blockchain ecosystems have not yet planned or established a standard.

Unsurprisingly, the Ethereum community is at the forefront. Ethereum introduced NFTs on January 24, 2018 with the ERC-721 standard. On June 17, 2018, the ERC-1155 standard was added.

It allowes tokens of fungible and non-fungible nature to be bundled into one contract and transferred together. Thus, transactions with different types of tokens are feasible.

Accordingly, owners of NFTs must take care to use wallets that comply with the relevant standards. Examples for Ethereum are Trust Wallet or Enjin Wallet.

Other blockchains with designs on planning or implementing Niftys include EOS, NEO, TRON, and FLOW.

Niftys can be traded and exchanged through a single ecosystem. In the future, this mechanism should also be realistic across ecosystems.

Collections vs. marketplaces

Another reason for the limited use is the still small number of collections and marketplaces.

Collections, similar to many ecosystems, are partially self-contained. A classic example of this are virtual worlds. NFTs are created in the virtual world and traded there by participants. But they can also be offered for sale in a marketplace outside of the dedicated virtual world. Hence, fluid transitions are possible.

Marketplaces allow owners to create and sell NFTs. In other words, interested parties can purchase NFTs at the offered price or via an auction bid. But these NFTs can also be traded on other platforms and between people, thanks to the ERC standard.

Examples of use and collections

The aforementioned representation of goods, assets and services forms one of the pillars of NFTs. NFTs are digital “twins” of their real-life counterparts. From Industry 4.0 to private use, there are many possibilities.

Nike, for example, issues the so-called CryptoKicks, which have a digital equivalent in the form of NFTs. Fashion company Louis Vuitton created handbags with equivalents on the blockchain.

Currently, the most widely used manifestation of NFTs is as digitally unique goods. Collectibles, whether in art, games or communities are issued as non-fungible tokens.

With the “Binance Collectibles”, the Binance trading platform gives away collectible NFTs in editions that are limited in number in their respective series, but different from each other. They are based on the ERC-1155 standard.

Decentraland is a virtual world where digital residents can trade fungible utility tokens (MANA, ERC-20). Non-fungible tokens (LAND, ERC-721) indicate land ownership that is obviously not replicable or interchangeable.

An example outside the crypto communities is the Azure Heroes Badges. Microsoft awards ambassadors from its own programs or those who have been nominated “badgers” in NFT form. The ERC-1155-based tokens can be stored in the Enjin Wallet and are exclusively assigned to the designated person.

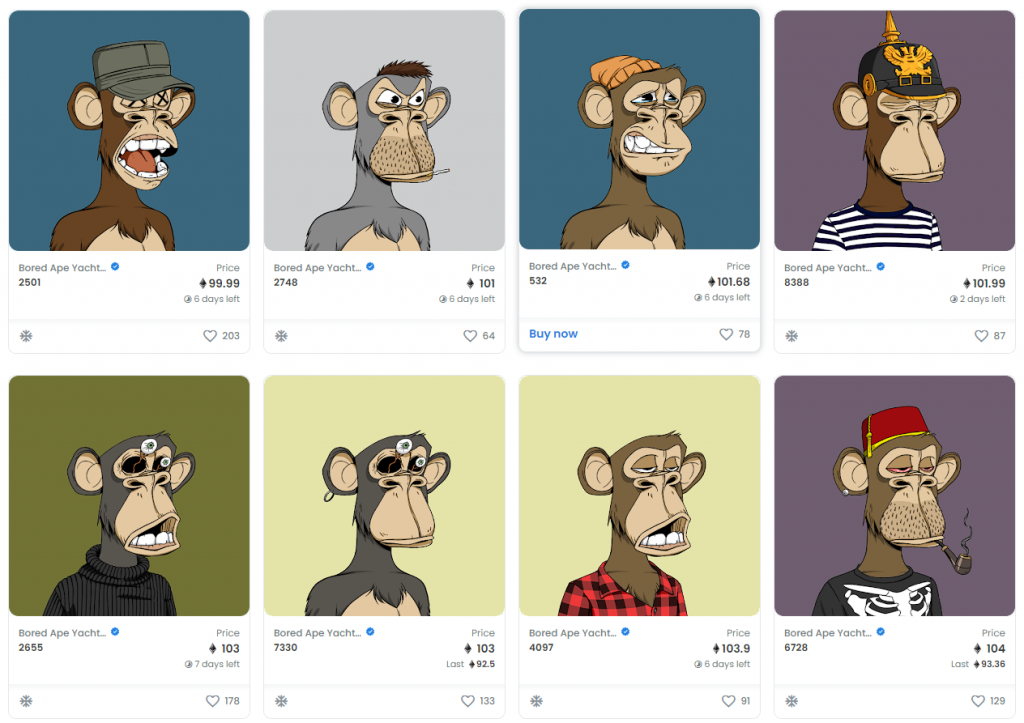

Marketplaces for non-fungible tokens

In principle, NFTs are freely tradable on all platforms. However, due to their uniqueness, no trading pairs can be formed to find exchange partners. To fill this niche various specialized marketplaces have emerged.

NFT owners advertise their treasures and find interested buyers on these platforms.The following marketplaces have gained reputation:

- OpenSea

- Rarible

- Looksrare

- X2Y2

- Crypto.com